Your automobile purchase under the magnifying glass

Keep more money in your pocket. Avoid buying yourself problems.

Keep more money in your pocket. Avoid buying yourself problems.

Caution! Don’t just calculate what you can spend every week, with each paycheque or every month for a car loan. Also determine a total amount. A small payment staggered over several years can add up to a huge expense.

A merchant cannot force you to finance your purchase. It’s your decision. Keep in mind, however, that you’ll usually pay a lot in credit fees, including interest. See for yourself using our calculator. Then, keep your eyes open: the amount charged in credit fees appears in your contract.

Before amortizing your payments over a long period, also keep in mind the lifespan of your car. Will it still be working right up to the day on which you will have paid off your debt? Will you have to cover major maintenance or repair bills in addition to your payments until then?

Got your eye on a used car? Have an independent inspection done, for example, by a mechanic you trust, regardless of whether the dealer claims to have already done so and even if the car seems fine. The dealer must also let you consult the expert of your choice, within a reasonable distance.

You must cover the cost of this inspection. It will let you know whether repairs are needed immediately or in the near future. You might find out that the car has been in an accident, that its odometer has been reset, etc. Whatever happens, you can negotiate the price of the vehicle accordingly, or decide not to buy the car.

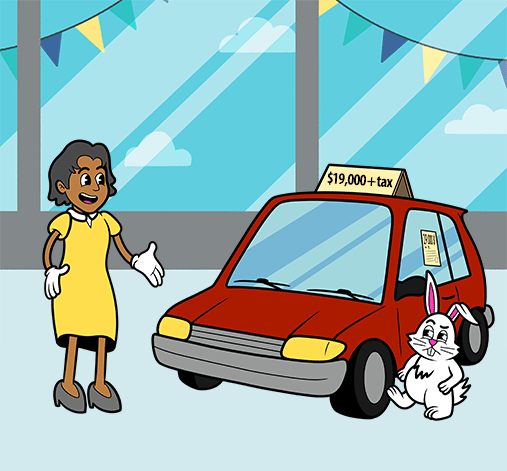

Ask from the start whether any fees are added to the advertised price (that appears on a sticker, an ad, online, etc.). If so, that’s illegal.

In addition to the advertised price, you’ll have to pay the GST and QST and the specific environmental duty of $4.50 per new tire. Nothing more. The seller may invoice administrative, transportation, preparation, delivery or cleaning fees, or an additional charge because you are not taking the financing plan offered to you, but such fees must be included in the advertised price. If they are added after the fact, refuse to pay them.

The advertised price can only be increased under one condition: you decide to make additional purchases that the advertised price did not cover (e.g., accessories, such as a trailer hitch or a luggage rack, or additional products, such as an additional warranty or a maintenance plan).

If you choose to finance your purchase, credit charges will be added. These include interest. They may also include other charges, such as register of personal and movable real rights (RDPRM) consultation and registration fees.

You can submit a Vehicle Record Request to the Société de l’assurance automobile du Québec or order a report from a vehicle history provider, for a fee. This will give you details about the car’s past: accidents, number of owners, prior use, etc.

To reserve a new vehicle, the dealer could ask you for a deposit or a promise to purchase.

In order to avoid any conflicts, only commit yourself once you have really made your decision. Only sign a document if it is crystal clear and leave the lowest possible amount as a deposit. For example, the document could include:

Ask to take a used car out for a road test. The dealer is required to let you do so. Take your time. You can drive over a few kilometres, on various types of roads. Make sure the radio is off so you can clearly hear any noises the car might be making.

It is also recommended that you:

It is very disappointing to find out, after the fact, that the car is unpleasant to drive, a door doesn’t lock or that the air conditioning doesn’t work properly.

The dealer cannot force you to buy an additional warranty (or any other goods or services). Take the time to properly evaluate the offer made to you. It may be to your advantage… or not.

Before making any payments, keep in mind that certain warranties apply automatically and free of charge. They stipulate that the vehicle must serve for normal use, for a reasonable length of time, based on the price paid. As such, thanks to these legal warranties, you benefit from some coverage once the manufacturer’s warranty has expired, even without an “extended” warranty.

Do you regret purchasing an additional warranty? You have 10 days to cancel it.

If you choose to finance the vehicle, the dealer may require that you hold insurance in the event of death, disability or loss of employment.

You can always satisfy this condition with an insurance policy you already hold, or shop for one elsewhere. You are not required to take out insurance with the vehicle dealer. The Autorité des marchés financiers provides more information on this subject on its website.

Paying over a long period of time means paying more in the end. Check the figures for yourself!

Amount payable

in addition to the

This calculator only provides an estimate: the amount obtained may be slightly different from the one paid in reality.

Does the dealer hold a road vehicle dealer’s permit to sell cars? Has the dealer received formal notices from other consumers? Has the Office had to intervene with the dealer in the past? Refer to the Get information about a merchant tool to find out.

If you are dealing with a merchant that is acting illegally, you can file a complaint with the Office de la protection du consommateur.

Do not hesitate to contact our agents. That way, we can take action against a dealer that adds fees to the advertised price or refuses to let you take a used car out for a road test or have it inspected.

Have this checklist on hand when you go to a dealership. And don’t hesitate to show it to them to assert your rights.

You can download a PDF version of the checklist or print it out.

Download or print the checklist

They point out that small payments can become expensive in the end, that mandatory fees added to the advertised price are illegal, and that it is important to have a used car inspected.

It covers several topics, such as assessing your needs and budget, what to check for before making the purchase, obligations of car dealers, etc.

Host Frédéric Choinière, journalist Mathilde Roy and actress Mylène St-Sauveur explore existential questions related to automobile financing.

You will find details on financing options, the contents of the contract, warranties, etc.